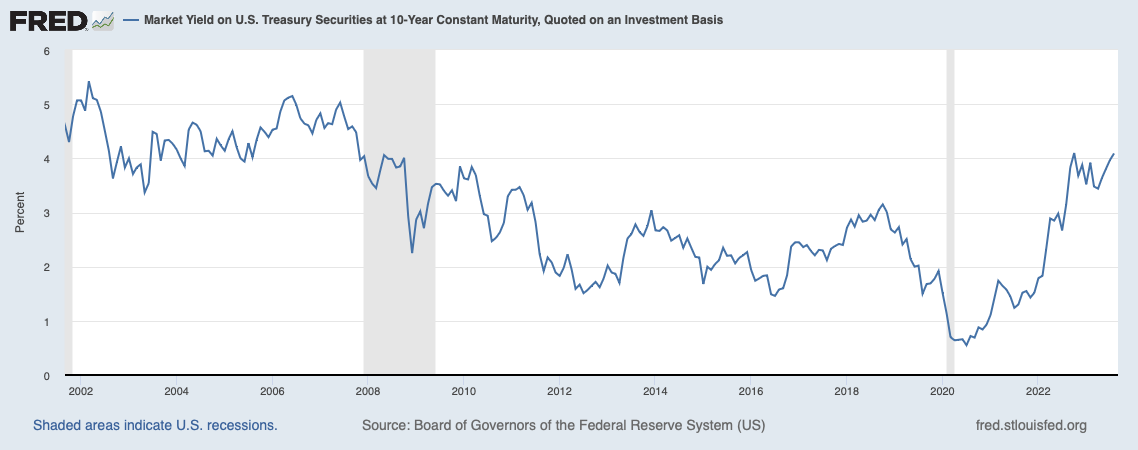

Economics in One Lesson (1946) by Henry Hazlitt highlights the law of unintended consequences. Hazlitt states that economics is about analyzing not only the immediate effect on a specific population but the long run effect on the general population as well. Written in 1946, one of Henry’s ending chapters highlights the consequences that the distortion caused by low interest rates. Interest rates are the price of money. Moreover, interest rates are a price of capital. When the price of capital is too low or too high, this may be beneficial in the short term for individuals borrowing money or prevents their borrowing. However, the longer term impacts the whole society, what are these?

Interest rates may be high now, and they were previously historically low. This government policy intervention has consequences for human flourishing. We should all be afraid when the government says they are here to help.

When interest rates are too Low?

Low for too long and there will be a reduction in both savings and lending. People are encouraged to make a trade off of buying existing capital instead of investing in new capital. Existing capital does not increase productivity. If the price of existing capital goes up faster than the return of new capital that is invested to create more goods and services, then long term production, think gross domestic product, will be less for everyone.

Additionally, savings and lending can either be for consumption or for capital goods. The marginal savers and spender, which is where most decisions are made, will be encouraged to consume over save when rates are too low. Consumption does little to further increase more production. Investments into new capital goods will increase the productivity and thus more production of goods and services for everyone. This will further have another impact, as productivity increases, caused by the investment into new capital goods, wages of workers increase, which are correlated to their productivity. The fact that politicians lament that workers wages have not increased as much as they would have liked in the last decade is caused by the super low interest rates that the government artificially set. It sure seems like the government is creating the problems that they say they should solve.

When interest rates are too High?

When interest rates are higher than the cost of capital into new capital causes substitution in the other direction. Instead of investing in new capital goods that would increase productivity and increase goods and services for everyone, capital slowly finds its way to non-productive uses. For example, the large inflows into government debt like T-Bills. It is nice that everyone can have a 5% short term rate on their savings, but there is a long term impact to society that is much more sinister - the reduction of higher growth. This is what we will likely never see and difficult to measure what could have been for our children’s children.

Further, the debt taking on during the low interest rate period for consumption still has to be serviced, sometimes requiring more money to service now. This debt service cost puts further pressure both on new capital investments and consumption as this pulled forward consumption now has to be paid for with what could have been used for either capital or consumption now. It is possible that a vicious cycle, perhaps slowly unfolding into low and slow growth, is how this materializes instead of a big crash.

Some caveats. We should never underestimate the market, the market of supply and demand is a very robust and is more powerful than any government. Humans innovate (act) around government distortions. There is a benefit with higher rates, as entities, both individual and corporate, will be incentivized to pay down debt under higher debt burdens. These incentives will take a while to materialize as the more pressing concerns and impacts are the higher debt service and decisions to move money from productive capital to unproductive but higher return capital goods.

News

- Energy Transfer (ET) announced a $7.1B all equity acquisition of Crestwood on 8/16. ET is a mid-stream energy provider that derives revenue primarily from fee based revenue from pipeline volumes. Among extending ET’s export capacity at 2 terminals and storage, this acquisition further increases gathering in the Williston, Delaware and Powder River basins. Press Release

- Enterprise Product Partners (EPD) paid a quarterly dividend of $0.50 per share. $26.32 (8/16). EPD has consistency increased its dividend since 1998 with some of the lowest leverage ratios in its industry. This dividends represents a 5.3% increase YoY. Press Release

- Upcoming: ET is distributing a dividend of $0.31 centers per share on 8/21 on a share price of $12.77 (8/16). Dividend Growth projected by management to be 3-5%.

</i> </span>