There is instability in the market. Government convinces you that the private market is the source of the instability. Government convinces you that it is the solution to this instability. All while the government is the source of the instability.

A market provides information by its prices.

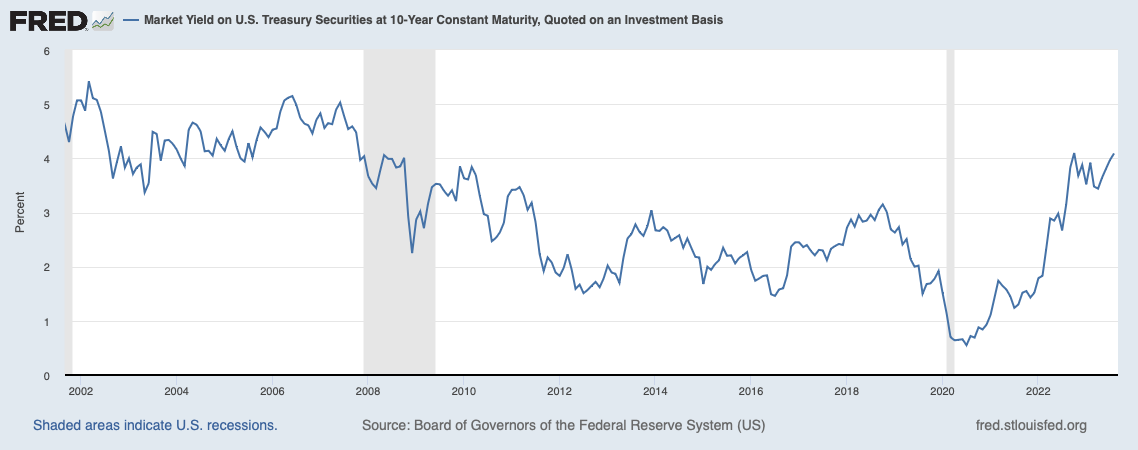

Last post we discussed the impact of lower than normal and higher than normal interest rates over a long term horizon. While the long term unintended consequences are typically hard to measure and occur slowly, a little at a time. The abrupt change in interest rate policy can have a more impactful consequence on portfolio policy if not managed well.

Stability

Stability is another unintended consequence, that is immediately forgone when the price of capital changes, especially substantially. We are observing currently and over the last year this impact of governmental control in the interest rate price. Businesses need stability to plan. When the price of capital changes by a significant amount more than planned, businesses have a difficult time planning. What happends next after the large increase from 1-2% to over 4% in the 10 year US Treasury bond?

Market Prices Change to a New Normal

The market looks for a new price to clear transactions when new information becomes available. The market is resilent in its power to overcome the distortion in the price of capital (interest rate), caused by governmental involvement via a central bank, whether up or down. The power in a market is that it discovers the right prices eventually, although ending up at a new distorted ending point. The more distortion the government provides, the more paintful this process may be as the market searches for the “right” price. Never underestimate a market. A new price will be found and the act of searching can be more painful in the immediately term.

Milton Friedmon Taught Us

The Great Depression is a lesson on what happens when the government continues to distort markets. These last few weeks I had a few moments to continue reading Free to Choose - A Personal Statement by Milton Friedmand and Rose Friedman. There is an excellent chapter on the The Anatomy of Crisis that details the events of the Great Depression, the response of the government, and cause and effect. The ending summary is epic as follows:

- The government convinces the public that the private economy is the source of instability.

- The government tells the populus that more governemnt is the solution to this instability.

- All while, the government is the ultimate cause of the economic instability.

What if?

The Great Depression lasted many years. Before the Federal Reserve, there were many runs on banks. What limited the duration of these runs on the bank, was that the banks banded together to support each other with funding and the banks limited the withdrawls. The duration was much less than a year. However, with the advent of the Federal Reserve, the responsiblity of this principle of subsidarity moved from the individual, as an actor of a bank, to the government, a disintereted third party. What if the pain we are seeing in the bond market today is all caused by the government?

Buy or Sell

The impact from the process of price discovery depends if you are a buyer or seller.

- A Seller of bonds today bought years ago is selling at a lost because bonds can be purchased at a much higher interest rate today.

- A Buyer of bonds today has the opportunity to secure a higher for longer payment in interest compared to the past.

The market is biased to the buyer today of bonds as the likelihood of much higher interest rates is very low because the national debt is so high and Federal Reserve appears to be towards the end of a hiking cycle.

Private Credit

The individuals who have bypassed the government in setting the price of capital they demand or need are impacted the least. The increase in private credit provides an excellent vehicle to both produce more goods and services and to provide the funders of this credit with adequate return for the risk. If a person buys or sells in a market without government interference, the return might even be higher.

An Application of High Interest Rate

More than the incorrect incentives higher than normal capital prices stimulate, we need to understand how this impacts portfolio policy. The time period we are in, with higher than normal cost of capital, needs to be examined for application.

TLDR

- We are in a period of underinvestment that will lead to lower goods and services produced in the following periods until investment is restored.

- Caveat 1 We might be coming out of a period of over investment, so we could net netural.

- Caveat 2 The amount of investment in new goods and services is dependent on the specific good or service.

- Most of all, a bond is likely to yield adequate cash flow with a nice protection of principle if one is forced to sell. We did not cover this in this post, but one should always be prepared to hold a bond to maturity to avoid any capital loss. This is how the pros invest. Protect Principle. Cash Flow for Compounding.

- Best to avoid government interference in markets while investing. Think Private Credit.

- If one invests in distorted markets, ensure the odds are in your favor as a buyer or seller.

</i> </span>